ECB opts for small arms fire rather than “big bazooka”... Worries about economic outlook intensify and should ease inflation concerns... With downside risks persisting, further rate cut likely, maybe very soon... Rate cuts may be a compromise given ECB reluctance to take more radical action on bond purchases... Cuts will buy ECB time but pressure to step-up bond buying will intensify unless current tensions ease.

The decision by the European Central Bank to cut official rates by 25 basis points today came as something of a surprise, but it is fully warranted by worsening economic conditions and increasing risks to economic and financial stability of late. Indeed, it can be argued that the ECB should have gone further, but the tone of today’s press statement suggests a further rate cut is a strong possibility in coming months. However, Mr Draghi signalled a continuing ECB reluctance to take more radical action in response to the crisis.

In many ways, today’s move asks more questions than it answers. Does it suggest the ECB envisages an even poorer outlook than that feared by the markets? Does Mr Draghi’s arrival signal a change in the thrust of ECB policymaking? Can a small rate cut make any difference? Or does it indicate how limited the response capabilities of the ECB are in the current circumstances? Is yesterday’s move a compromise offered by the ECB in return for its reluctance to take a more aggressive role in combating the sovereign debt crisis?

The ECB has changed leadership but not direction.

Mr Draghi’s performance at today’s press conference was assured. The contrast in his demean our to the battle weary visage of Mr Trichet in recent months testifies to the toll the financial crisis places on the ECB president. While Mr Draghi appeared entirely comfortable, he offered relatively little insight into the rationale for today’s decision or any new perspective on the role the ECB envisages for itself in the crisis. This is not surprising. Mr Draghi is the first ECB President from outside the ‘core’ Northern Euro area economies and, as an Italian, he comes from a country that is close to the centre of the financial storm at present. For these reasons it was expected that Mr Draghi would seek to establish his credibility by emphasising continuity in ECB policymaking. In cutting rates today, the ECB Council is sending a signal that economic prospects rather than personalities will determine its rate policy. Aside from the rate move Mr Draghi presented a very conservative image today that points towards continuity rather than change in ECB policymaking.

Economic Circumstances Have Changed For The Worst

The backdrop against which Mr Draghi takes the helm at the ECB has changed dramatically in recent months as the financial crisis has intensified and the economic outlook deteriorated markedly.

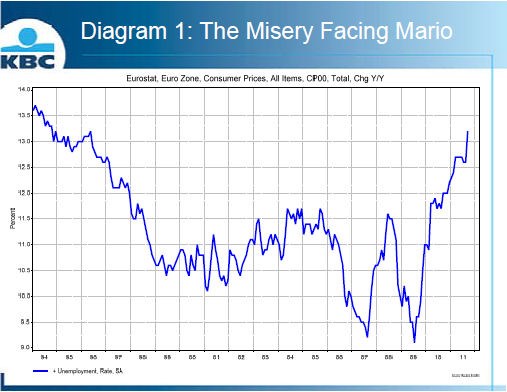

It is worth highlighting the threatening combination of weak growth, associated high unemployment and elevated inflation at present that make for a particularly unfavourable environment. Diagram 1 below sets out the traditional ‘misery index’ (the sum of the unemployment rate and the inflation rate). On this fairly crude measure macroeconomic conditions in the Euro area are now at their poorest since the mid 1990’s. More significantly, the outlook has darkened rather than brightened of late.

Three months ago ECB staff projections envisaged growth of 1.6% in 2012 but last week the OECD cut its forecast for next year to just 0.6%. The change from a modest to a feeble growth outlook is particularly problematic given the pivotal importance of growth performance in easing or worsening the substantial debt burden that weighs on a range of Euro area economies at present. Mr Draghi recognised this in today’s rate reduction and also in comments that point towards the possibility of another rate cut in the months ahead when he noted “the economic outlook continues to be subject to particularly high uncertainty and intensified downside risks. Some of these risks have been materialising, which makes a significant downward revision to

forecasts and projections for average real GDP growth in 2012 very likely. In such an environment, price costs and wage pressures in the Euro area should also moderate; today’s decision takes this into account.” In response to a question at today’s press conference, Mr Draghi indicated that the ECB envisaged a relatively mild recession. This would justify the relatively modest action taken today while keeping powder dry against the risk of poor economic numbers in early 2012.

Of course, the recent deterioration in economic conditions is inextricably linked to the renewed worsening of the financial crisis. In these circumstances, it is questionable what a 25 basis point rate cut today might achieve. It certainly buys the ECB some time. It will be well received politically and because short rates are particularly important in some peripheral Eurozone economies such as Spain and Ireland, it will have some modest positive impact on sentiment and spending power. In addition, as markets like to travel in hope, the possibility of a further rate cut in coming months may also help the mood among traders. While the ECB used its artillery today, it was very much small arms fire rather than the bazooka many in the market feel is required to resolve the crisis. In time disappointment may set in because a rate cut could be seen as a poor substitute for more radical action. Certainly, Mr Draghi stuck closely to the orthodox ECB view in relation to its controversial bond purchase scheme (Securities Market Programme). Mr Draghi said that the SMP was (1) designed to be temporary, (2) limited in scale and (3) justified on the basis of assisting the functioning of the financial system. So, Mr Draghi reaffirmed the ECB’s longstanding view that its bond buying scheme is intended to be small and short-lived. He was similarly firm in rejecting any role for the ECB as lender of last resort.

In response to a question on Italy, Mr Draghi emphasised that problems with rising bond yields need to be addressed by natural authorities through budgetary adjustment and structural reform rather than through Central Bank intervention. In this context, it is important to emphasise that last week’s EU summit was notable for the absence of any new responsibilities for the ECB in the framework intended to resolve the crisis. While some market participants continue to see the ECB as the only institution that can make a decisive intervention, at this point, public pressure on the ECB for early action has been significantly reduced. In practice, this should give the ECB greater room for manoeuvre to take further radical measures. However, through this rate cut, the ECB is also sending a strong signal that is not a road it wants or intends to travel anytime soon. The key uncertainty is whether market tensions will force its hand.