Czech koruna’s upside move should be limited

The Czech koruna gained on higher Polish inflation coming closer to the important 55-day moving average, currently at 24.35 EUR/CZK. Although the initial reaction was positive, we are somewhat hesitant to believe the koruna can continue to track the gains of Polish zloty.

There is quite substantial difference between both economies. Polish inflation is now nearly 2 percentage points above the inflation target and is set to rise further. Czech inflation declined further and is set to remain below the target for the coming months. Beside that, Czech fiscal policy is much more restrictive compared with the Polish and the situation on the Czech labor market is clearly much worse. That is why the CNB can stay with the rates at historical lows for the whole first half of the year and Czech koruna should not be able to profit from hiking story for now. Yesterday it was also confirmed by vice-governor Tomsik, who reiterated that he is still joining the dovish camp.

Meanwhile, the Czech MinFin easily sold a 12Y floater benchmark as the bid-cover ratio reached 2.9. The outcome off the auction showed that (volatile) domestic politics has no impact on the domestic bond market.

Hungary

The Hungarian forint ended yesterday’s session almost unchanged. The EUR/HUF pair dropped marginally from an opening level of 266.48 to close the session at 266.32.

Hungary’s Economy Minister Gyorgy Matolcy said yesterday that the country doesn’t need further measures to reach its budget deficit targets as last month’s fiscal adjustment package ensures targets will be met even under a conservative growth scenario. Even if the growth rate approaches only the very conservative estimate of around 3%, there is no need for additional measures. Markets rallied ahead and after the reforms were announced, but investors are still waiting to see the exact details of the measures announced.

This morning, Hungarian industrial production data came out exactly in line with expectations, rising by 0.9% M/M, unchanged from the first estimate.

Poland

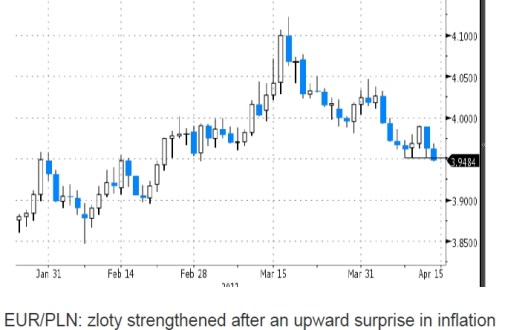

The Polish inflation in March leapt by 0.9% m/m and reached 4.3% y/y. Hence, the reading easily beat market expectations. The rise in consumer prices was mainly driven by food prices (2.1% m/m, 6.8% y/y). In a response, the spread between FRA 1x4 and three month WIBOR reached 35 basis points and the zloty is trading below 3.95 EUR/PLN, i.e. at the strongest level since the end of February.

The hawkish camp in the Monetary Policy Council (MPC) exploited the situation right after the release. Jan Winiecki said that the MPC undoubtedly needed to act and Anna Zielinska-Glebocka said that the hike would be justified as soon as possible. On the other hand, dovish Elzbieta Chojna-Duch told Reuters that inflation was driven by factors which are out of control and that higher inflation expectations were unlikely to leak into wages due to the high unemployment and weak trade unions.

Nevertheless, we revise our scenario that bets on a rate hike in July. We think that a further round of monetary tightening could probably come in June. Moreover, the rate hike might even come as early as at May’s meeting (5/11) if the rest of figures released this month is more pro-inflationary than expected.