By Vojtěch Jirásek

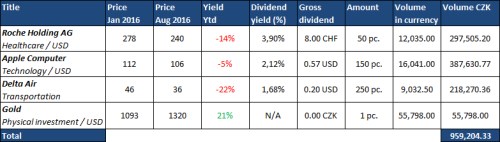

Here I created a portfolio for a client with 1,000,000CZK on their newly made account.

The portfolio is balanced in three different industries: healthcare, IT and industrials, which involves a risk profile, meaning that the investor needs to have the willingness to take risk for his individual and essentially emotional property. It is important to first assess whether the client is ready to suffer financial losses initially with the hope of higher earnings in the distant future or prefers a small secure and sustainable yield from the beginning. In this case the client should be ready to tolerate potential losses and seek to achieve higher yield.

On the other hand the investment into gold is going to have a much lower risks associated with it, but also lower rewards if the price does increase. This is because gold prices have been increasing with a very gradually, but yet positive, trend in the last few months, as seen on the graph below. This trend makes the investment relatively risk-free, in terms of its price decrease.

Opportunities and risks associated with the investment:

Holding AG:

• Currently developing new pipeline containing around 10 new drugs that could enter the market in the next few years, which is a huge opportunity for the business as it could result in them becoming the most well recognised company in the Healthcare market.

• On the other hand the risk is that the drugs may not be successful and popular on the market, which would have a negative impact on the company’s reputation and therefore decrease the share price and the dividend payments.

• “Another potential problem with Holding could be possible regulations in the industry. This is because all companies operating in the healthcare industry are hugely influenced by the government. For example if there is a new regulation is introduced, prohibiting production of a certain drug, Holding will have to follow this regulation, which could have a significantly negative impact on their revenue.”

Computer:

• On 16th September will be launching their new IPhone, increasing their revenue and also profits. This is likely to increase the annual dividend yield that is currently on 2.12%. is only paying out 40% of its earning as dividends, which is a relatively small amount compared to competitors such as , who pay out 70% to shareholders.

• Apple is a well-established company with a great reputation worldwide. This lowers the risks. However the main risk is that the actual revenue generated from the new IPhone will not be as high as the estimated ones, which may not cause a very influential increase in profits and therefore the increase in the annual dividend repayments to shareholders will not be as significant.

Delta Air:

• Delta Air share price has been fluctuating for a long time, for example just recently there was a 1.04% fall in share price, however this could mean that the price is very likely to bounce back up again in the future. This investment can have very high rewards mainly because of the current record low share prices of 36.13USD.

• On the other hand the risks are also high because of the high competition in the industry such as Virgin or British Airways and also the changing supply and demand for air travel.

Gold:

• Gold is an example of a ‘’low risk’’ investment with modest returns. This is because the money is protected against currency devaluations, inflations and uncontrolled actions of the governments, also gold is extremely liquid (can easily be converted in to cash) and holds its value over time.

• However there are no dividend payments associated with the investment, so the only way to make profit is to hope for an increase in its price, the problem being that there is a very slowly increasing trend.