By Vojtěch Jirásek

The foreign exchange market had been the domain of large financial institutions, corporations or central banks. Internet enabled individuals/investors to buy and sell currencies easily with the click of a mouse. On one hand the forex market provides great opportunity for investors because of the extreme liquidity and the availability of high leverage, which led to rapid growth of the market in general. On the other hand in order to be successful, an investor must be familiarised and understand the reasons behind daily currency fluctuations. This is because the high leverage can not only accelerate large profits, but also mass losses.

There are 8 main causes of fluctuations in exchange rates, and most are related to the trading relationships between countries and rest are a response to the supply of and demand for international money transfers.

1) Inflation Rates:

A country with a lower inflation rates than another’s will often experience an appreciation (increase) in the value of its currency, due to the prices of goods and services increasing at a slower rate. The value of the increase in inflation (rise in domestic price level) is often accompanied by decreased interest rates, causing a fall in the internal purchasing power of money, and hence a fall in the exchange rate.

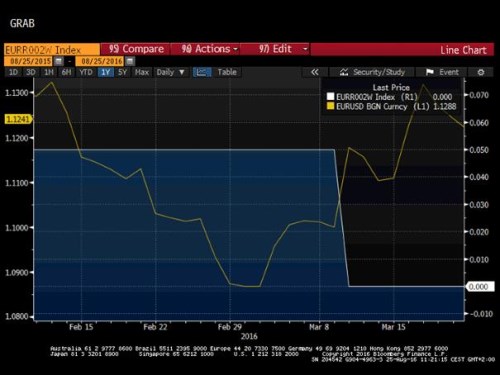

Market expected the European Central Bank to decrease interest rates, which resulted in depreciation of EUR by 400 points.

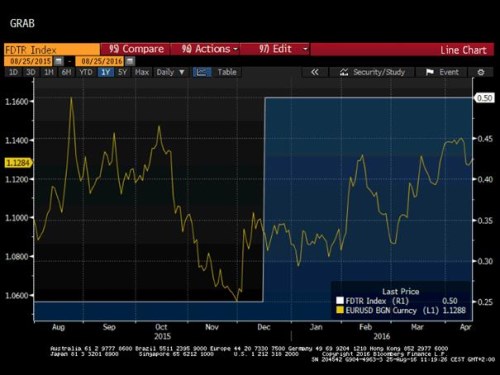

2) Monetary Policy (changes in interest rates):

Increase in interest rates cause a country’s currency to appreciate as they provide higher rates to lenders, thereby attracting more foreign capital, and leading to a rise in exchange rates of the country. The future predictions are also very important, for example if ECB is expected to decrease interest rates (possibly making them negative) euro will start to weaken and therefore will not profit its investors, who will want to get rid of it.

On the other hand low interest rates spur consumer spending and economic growth.

Market expected an increase of Fed key rate, resulting in appreciation of USD by 800 points.

3) Country’s Current Account:

The current account reflects balance of trade and earning of all foreign investment, consisting of total number of transactions including exports, imports, etc. The deficit in current account due to imports exceeding exports causes depreciating exchange rate value of its domestic currency.

4) Government Debt:

A country with high government debt is less likely to acquire foreign capital, leading to inflation. There is a greater likelihood of foreign investors selling their bonds in the open market if the market predicts government debt within a certain country. As a result, a decrease in the value of the county’s exchange rate will follow.

5) Terms of Trade:

Related to current account, the terms of trade is the ratio of export prices to import prices. The terms of trade are likely to improve, if exports prices rise at a greater rate than the import prices. This results in higher revenue and increased GDP, which causes a higher demand for the country’s currency and therefore an increase in its currency’s value, leading to an appreciation of exchange rate.

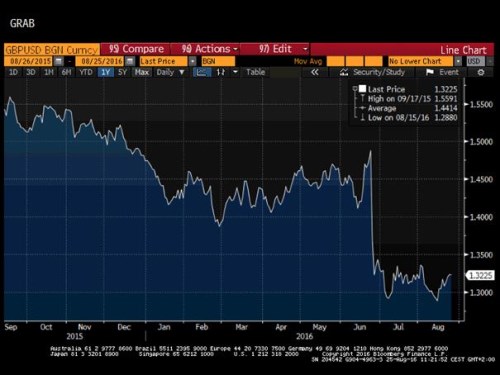

6) Political Stability & Performance:

A country with less risk for political turmoil is more attractive to foreign investors, as a result, drawing investment away from other countries with less political and economic stability. The increase in foreign capital leads to an appreciation in the value of its domestic currency.

7) Current state of the Economy:

When a country experiences recession, the central bank is likely to decrease interest rates to encourage consumers to lend. However this decreases its chances to acquire foreign capital. As a result, its currency is weakened in comparison to that of other countries, causing depreciation of the exchange rate.

8) Speculations:

If a country’s currency value is expected to rise, investors will demand more of that currency in order to make profit in the future. As a result the value of the currency will rise due to the increase in demand. This increase in currency value brings a rise in the exchange rate as well.

Speculators forecasted appreciation of GBP after British referendum (Brexit), the opposite result lead to a sharp depreciation of the British currency.

One the other hand, if the exact opposite happens and the future predictions are very negative then the demand of that particular currency will fall. This is what happened after Brexit, where a large number of investors very not certain about future and decided to sell their pounds. This later led to a further drop of the pound value.

In conclusion, good understanding of why and how these determinants lead to fluctuations of exchange rates can be vital for success in the Forex Market, as it enables investors to predict the future fluctuations as accurately as possible. However, there is always some extent of risk in Forex Market trading. Investors have to be really careful with choosing their next step in order to achieve the objective of maximizing profit.