Regional forex and fixed-income markets have kept their positive sentiment as macro data from Central Europe flow has been neutral to slightly negative (see today’s releases of Hungary’s trade balance and the Czech unemployment rate), while hopes related to the Greek deal have been generally supportive for regional assets.

Today, the NBP interest-rate-setting meeting should be the most interesting item in the region. The polish central bank is unlikely to change rates at today’s meeting. Although the market had bet on a rate cut within a nine-month horizon, the news from the last meeting as well as central bankers’ comments have made it fairly clear that rates are unlikely to change soon. According to a preliminary GDP forecast for last year, the Polish economy grew by 4.3%, in spite of rate hikes in the first half of the year, and the start of 2012 was also very good – January’s business mood figure surprised the market very positively, and the aggregate index even hit 52.15 points. Moreover, households’ inflation expectation soared above 5% which is another piece of hawkish news. However, this should be partly eliminated by the strengthened Polish zloty.

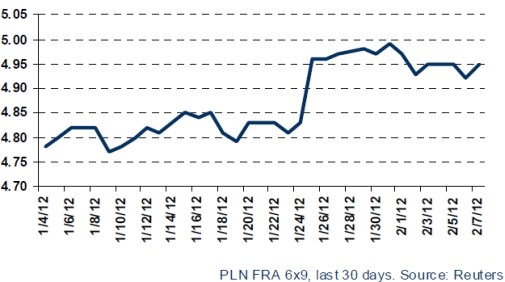

As concern market reaction it should be only limited as currently the FRA market has almost priced out the interest rate cuts for 2012. FRA 6X9 is currently only 5 bps below 3-month WIBOR.

FRA markets have priced out bets on interest rate cuts in Poland