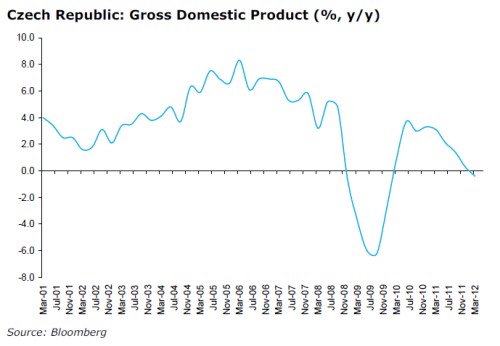

GDP in Q1 Final: -0.8% qoq; -0.7% yoy

First estimate: -1.0% qoq; 1.0% yoy

Second release of GDP data moderated negative figures, however, it did not change the fact that the Czech economy dropped into recession. Positive impact of net exports did not offset weak domestic demand. GDP data support an idea of CNB’s rate cut. Detailed breakdown confirmed expected structure of GDP figures. Household consumption expenditures dropped by 2.3% q/q. Fading demand hit especially expenditures on durables goods. Household demand suffers from declining real wages, an increase of lower VAT rate and record-high fuel prices. An increasing number of negative news from Euro area also deters households from spending. Government consumption rose by 2.0% q/q, but the government is likely to tighten screws again to keep the budget close the planned level. Fixed capital investment decreased by 8.6% q/q. Net exports remain the brightest point of GDP data, exports rose by 8.2% q/q, imports by 7.4% q/q. Nevertheless, it was not sufficient to offset the negative impact of weak domestic spending. Sector breakdown shows rising production in the industry and declining value added in construction and services. Compared to other economies in the region, the performance of the Czech economy seems to be disappointing. In comparison with the previous quarter, GDP rose by 0.8% in Poland, 0.7% in Slovakia, 0.5% in Germany and 0.2% in Austria. Only in Hungary, GDP dropped by 1.3% q/q. Output gap, estimated by the production function approach, widened to 1.1% of potential output in Q1 from 0.6% in Q4 2011 and it could open further to 1.5-2.0% in the course of 2012. In 2012, GDP is likely to decrease by 1.0% according to our model. This forecast implies a chance of a rate cut by CNB in coming months, possibly at the end of June.