Worsening perspectives of the U.S. economy (the world’s top oil consumer) as well as the stronger U.S. dollar (result of Greek sovereign debt crisis) have weighed on the price of oil in past few sessions.

The worst result of the Philly Fed figure since summer 2009 and the IMF’s downward revision of the U.S. economic growth outlook weighed on global sentiment on Friday. The U.S. benchmark WTI underperformed its North Sea peer Brent, although the U.S. Department of Energy said earlier in the week that oil inventories in Cushing dropped in the third consecutive week. Hence, Brent – WTI spread widened to about 20 USD per barrel.

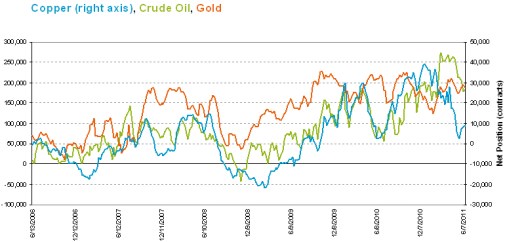

As far as the Commodity Futures Trading Commission (CFTC) report is concerned, it has said that speculative short positions remained at the highest levels since the beginning of February (see the chart).

Metals

Copper has extended previous losses and the price of the red metal has been falling for the fourth consecutive session. Worsening perspectives of the global economy and stronger dollar pushed copper price below 9000 USD per ton level today in early trading.

Nevertheless, risks in the medium term remain skewed rather to the upside since it is likely that Chinese consumers (approximately 40 percent of the world’s total demand) will come back to the market in months ahead as domestic copper stocks will be drawn.

Unlike the rest of commodities, stronger U.S. dollar does not trigger sell-off of gold. The yellow metal (which is well-known for its safe-haven status) benefits from the Greek crisis and hence is still trading well above the 1500 USD per troy ounce level. Moreover, regarding the gold price in EUR terms, the metal is trading in sight of an all time-highs.

Chart of the day: Money Managers net positions

The CFTC regular Commitment of Traders report (futures only) unveiled more or less neutral stance of speculative community towards copper, WTI and gold.

Regarding WTI market breakdown, significant decrease in Money Managers’ WTI long positions during past two weeks was accompanied by even higher percentage increase in their short positions. That is, some market participants clearly bet on shortterm correction in crude prices.

(source: CFTC)