Headlines

- Czech koruna might ease after ECB and CNB press conferences

- CNB will stay on hold and reveal new macro projection

Beside the ECB pess conference, the Czech forex and fixed-income markets should closely watch the domestic central bank – the CNB, which also meets today. Although some markets players believe that the CNB could hike today, we think that the bank will stay on hold. The lack of demand-pull pressures, the relatively strong koruna, and inflation below the CNB target will make the majority of the CNB Board members decide to leave the repo rate at an all-time low. Drawing attention this time may be not only the outcome of the CNB Board’s vote (we believe that it may be 5:2, with the latter group voting for a rate hike) but also on the new forecasts. The forecast may be of interest if the CNB increases the implied trajectory for shortterm market rates. Still, we do not expect huge impact on the Czech yield curve, while it might lead to widening of the interest rate differential between euro and CZK rates. Such a development might pose a challenge for the koruna in coming weeks.

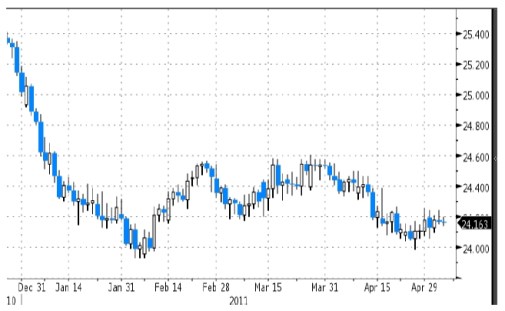

Koruna in wait-and-see mode ahead of the CNB and ECB meeting

The Polish zloty weakened yesterday in the late afternoon and closed above 3,95 EUR/PLN.

Today, the long-awaited ECB monetary policy meeting is taking place. We believe that the ECB will announce further round of monetary tightening will take place at the meeting in June. Our ECB view is very much based on the way the ECB acted in the early stages of the previous tightening cycle, including the use of code words to signal its intentions. Hence, CE currencies (including the zloty) might be under the pressure in a short term.