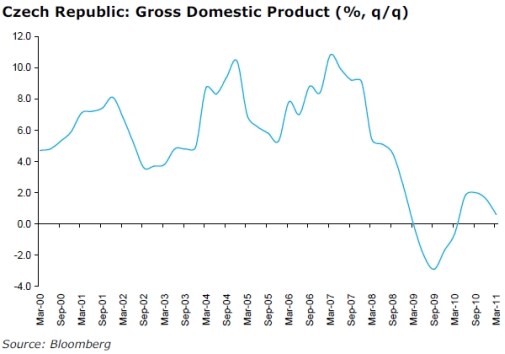

Actual (Q1/11): 0.6% qoq; 2.5% yoy

Consensus: 0.5% qoq; 2.4% yoy

Previous (Q4/10): 0.3% qoq; 2.6% yoy

GDP figures came out slightly better than average market forecast. Nevertheless, it could be seen as a slight disappointment when compared with the stellar performance of the German economy in Q1. The detailed breakdown of GDP data will be published in June. Comments released by the statistical office confirmed that the growth is based on foreign demand supporting industrial output and exports. The former gained 12.7% yoy, the latter 21.6% yoy in Q1. It stems from the fact that the Czech Republic neighbors with countries with solid growth. In Q1, GDP in annual terms rose 5.2% in Germany, 4.2% in Austria and 3.5% in Slovakia. Demand from these countries represents the most significant stimulus for the Czech GDP. Fixed capital investment also contributed positively and did not fulfilled worries that the end of the main wave of investment to the solar energy equipment would lead to a drop of the overall investment activity. Rising company profits, improving balance sheets and recovery of bank lending helped to stimulate investment in fixed equipment and offset negative photovoltaic factor. Fiscal austerity measures resulted in the decline of the “production” of the public sector included in GDP. Wage cuts in the government sector also negatively affected household consumption expenditures. Overall, fiscal policy is likely to reduce GDP growth in 2011 by 0.6 percentage point. Our forecast for GDP this year remains unchanged at 2.4%. In 2010, the economy rose by 2.2%.