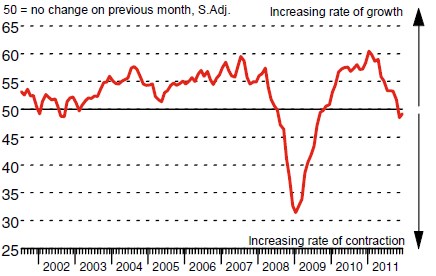

December PMI data for the Czech manufacturing sector indicated a sustained worsening in overall business conditions. The Czech Republic Manufacturing PMI, a composite single-figure indicator of manufacturing performance, remained below the no-change mark of 50.0, indicating a back-to-back deterioration in the manufacturing business climate.

The Index improved slightly from November’s 27-month low of 48.6, to 49.2, indicating a slower overall contraction of the sector. On a quarterly basis, the PMI averaged below neutrality (49.8) for the first time since Q3 2009 (46.7).

“The December PMI reading is marginally better than the November one but remains in contraction territory and, accordingly, the focus needs to stay on the downside risks to economic activity in the coming months,” Agata Urbanska, Economist, Central & Eastern Europe at , said.

Czech Republic Manufacturing PMI

The PMI is derived from indicators for new orders, output, employment, suppliers’ delivery times and stocks of purchases. One of the key components, new orders, signalled a faster rate of decline in December. New business has fallen for two months running, and the latest contraction was the strongest since July 2009. New export orders also declined for the second successive month, with firms commenting widely on the crisis in Europe affecting demand for goods.

Lower intakes of new work led manufacturers to cut workforces and purchasing further in December. The rate of decline accelerated slightly in the case of employment, while a weaker fall in input volumes was registered.

Although new business fell in December, the volume of outstanding work rose slightly. This mainly reflected almost no change in output compared with November. The lack of production growth also impacted on finished goods stocks, which fell at a rate similar to October’s 16-month record.

Despite the overall decline in purchasing activity in the manufacturing sector, suppliers’ delivery times continued to lengthen, as they have every month since September 2009. Moreover, the extent of delays worsened, as a number of firms reported shortages of inputs.

Inflationary pressures remained relatively subdued. Average input prices rose for the second month running, but at a modest rate in the context of historic survey data. Meanwhile, firms cut their output prices slightly as they sought to boost sales volumes in the face of strong competition.

(Markit Economics)